/ Globe PR Wire /

The global financial markets have been caught in a delicate balance as stocks struggle to maintain momentum, while bond yields edge higher. Investors are closely monitoring trade policy shifts, inflationary trends, and interest rate expectations, all of which are shaping market sentiment.

The latest inflation data provided a temporary sense of relief for traders, yet uncertainty lingers as the effects of escalating trade tensions become more evident. Financial strategists from Fibonachis shed light on these economic developments, exploring how they could impact investment strategies and market stability.

Trade Tensions and Market Response

Market volatility has been fueled by rising concerns over global trade policies. The recent imposition of 25% tariffs on steel and aluminum by the U.S. has led to retaliatory measures from the European Union, heightening fears of an extended trade war. This uncertainty is weighing on equities, with stock indices struggling to hold onto gains.

The S&P 500 saw a modest increase of 0.4%, while the Nasdaq 100 climbed 0.9%, driven by gains in the technology sector. However, the Dow Jones Industrial Average dipped slightly by 0.1%, reflecting investor caution. Meanwhile, bond markets reacted with short-term Treasury yields reversing earlier declines, highlighting the broader uncertainty among investors.

Inflationary Pressures and Interest Rate Outlook

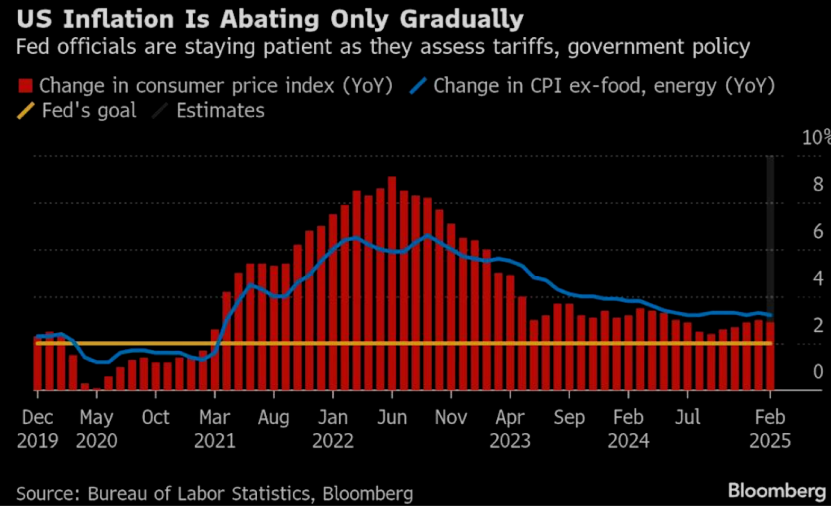

The latest consumer price index (CPI) data indicated a slower-than-expected rise in inflation, which initially reassured traders. However, economic experts caution that this could be a temporary slowdown rather than a lasting trend. Inflationary pressures remain a key concern, particularly as trade policies continue to impact supply chains and consumer prices.

The Federal Reserve is taking a measured approach, emphasizing that a single month of softer inflation data is not enough to warrant an immediate shift in monetary policy. Policymakers are likely to assess further economic indicators before making any decisions on interest rate adjustments. Market expectations suggest that a quarter-point rate cut may still be on the table for mid-2025, contingent on labor market performance and broader inflation trends.

Market Reactions and Sector Performance

While inflation concerns persist, certain sectors of the stock market have experienced notable movements. Tech stocks, including Nvidia and Tesla, saw gains, with Tesla extending a two-day rally to 12%. However, some industries have faced challenges—consumer robotics company iRobot saw its stock plummet by 29% due to financial instability concerns.

The bond market has also experienced fluctuations, with the yield on 10-year U.S. Treasuries rising to 4.30%. European markets are seeing similar trends, with Germany’s benchmark bond yields approaching 3% for the first time in 18 months, driven by expectations of increased government debt issuance.

The Federal Reserve’s Next Move

Central bank policymakers remain cautious as they navigate economic uncertainties. While some investors had anticipated early rate cuts, financial analysts emphasize that the Fed is unlikely to act hastily. The resilience of the labor market, along with evolving inflation expectations, will play a critical role in shaping the Fed’s upcoming decisions.

Economic strategists highlight that the central bank needs to ensure inflation expectations remain stable before making any adjustments to monetary policy. If inflation continues to moderate, a rate cut could provide some relief to financial markets. However, any signs of renewed price pressures could prompt the Fed to maintain its current stance for a longer period.

Hedge Funds and Systematic Trading

Hedge funds and institutional investors have been adjusting their positions in response to market turbulence. Data from major investment banks indicate a significant de-risking effort, with hedge funds reducing their exposure to equities at the fastest pace in four years. Systematic traders, including Commodity Trading Advisors (CTAs), have contributed to the selling pressure, adding to market volatility.

Rebalancing flows from leveraged exchange-traded funds (ETFs) have also been a major factor in recent market movements. Analysts estimate that ETF-related selling reached $52 billion over the past month, with a notable $16.5 billion in one day alone. These large-scale adjustments underscore the shifting sentiment among institutional investors.

Economic Projections and Investor Sentiment

As 2025 unfolds, the economic narrative is shifting. While inflation was the primary concern at the start of the year, investors are now turning their attention to broader economic stability, including labor market strength and GDP growth. Trade policies remain a wildcard, as continued tensions could have ripple effects across multiple industries.

Goldman Sachs has revised its outlook for U.S. equities, lowering its target for the S&P 500 from 6,500 to 6,200. The downgrade reflects slower GDP growth projections, increased trade policy risks, and a higher equity risk premium. European markets, however, have shown some resilience, with improved earnings expectations providing a counterbalance to U.S. market volatility.

Conclusion

As investors navigate 2025, the intersection of trade policy, inflationary trends, and central bank actions will be critical in shaping market performance. The shifting economic landscape demands a balanced approach, with traders and institutions carefully evaluating risks and opportunities. While uncertainties remain, staying informed on key economic indicators and policy shifts will be essential for making sound investment decisions.

The post Market Volatility and Trade Tensions: What’s Shaping the Economic Landscape? appeared first on Insights News Wire.